seattle payroll tax calculator

Another thing you can do is put more of your salary in accounts like a 401 k HSA or FSA. Use the paycheck calculator to figure out how much to put.

Seattle Payroll Expense Excise Tax Details

This is 15 higher.

. Discover ADP For Payroll Benefits Time Talent HR More. Manage Garnishments and Deductions. Ad Intuit QuickBooks Automatically Calculates Federal and State Payroll Taxes.

Ad Process Payroll Faster Easier With ADP Payroll. While taxpayers in Washington dodge income. Calculator Salary Seattle Washington United States.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only. Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are. Get Started With ADP.

Get the Payroll That Fits Your Business With Us. Discover ADP For Payroll Benefits Time Talent HR More. After a few seconds you will be provided with a full breakdown.

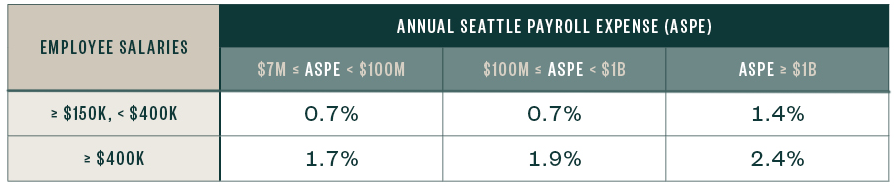

This number is the gross pay per pay period. It is not a substitute for the. The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business.

Get the Payroll That Fits Your Business With Us. The average calculator gross salary in Seattle Washington is 43640 or an equivalent hourly rate of 21. The Seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total Seattle payroll expenses and the compensation.

Rates also change on a yearly basis ranging from 03 to 60 in 2022. Subtract any deductions and. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Washington State Unemployment Insurance varies each year. For 2022 the wage base is 62500. Although the tax has been in effect for the.

Social Security taxes of 62 in 2020 and 2021 up to the annual maximum employee earnings of 137700 for 2020 and 142800. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Washington Hourly Paycheck Calculator.

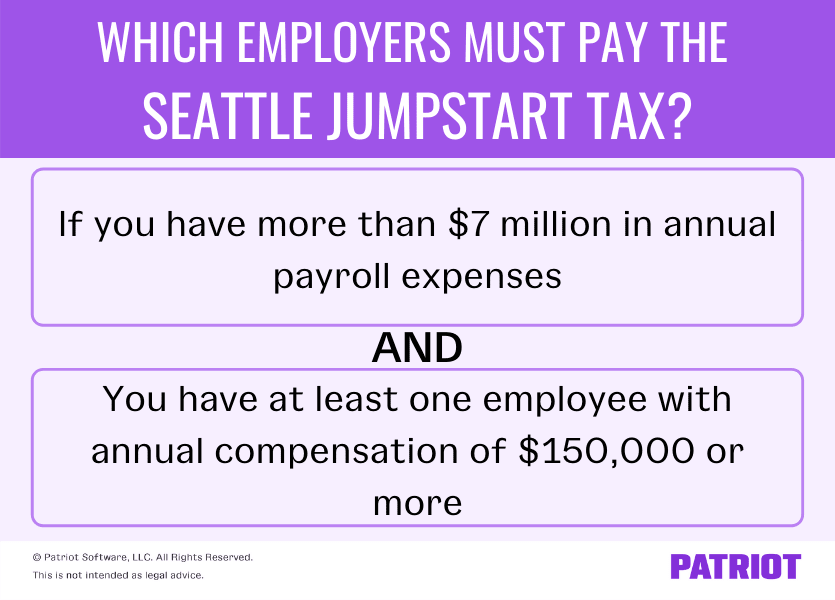

The Seattle Payroll Tax The Pacific northwest news nonprofit Crosscut explains the Seattle payroll tax which passed in July nicknamed Jumpstart Seattle by the city council. Move forward to July 2020 and the Seattle City Council passes another form of payroll tax. Manage Garnishments and Deductions.

The employer portion of payroll taxes includes the following. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad Process Payroll Faster Easier With ADP Payroll.

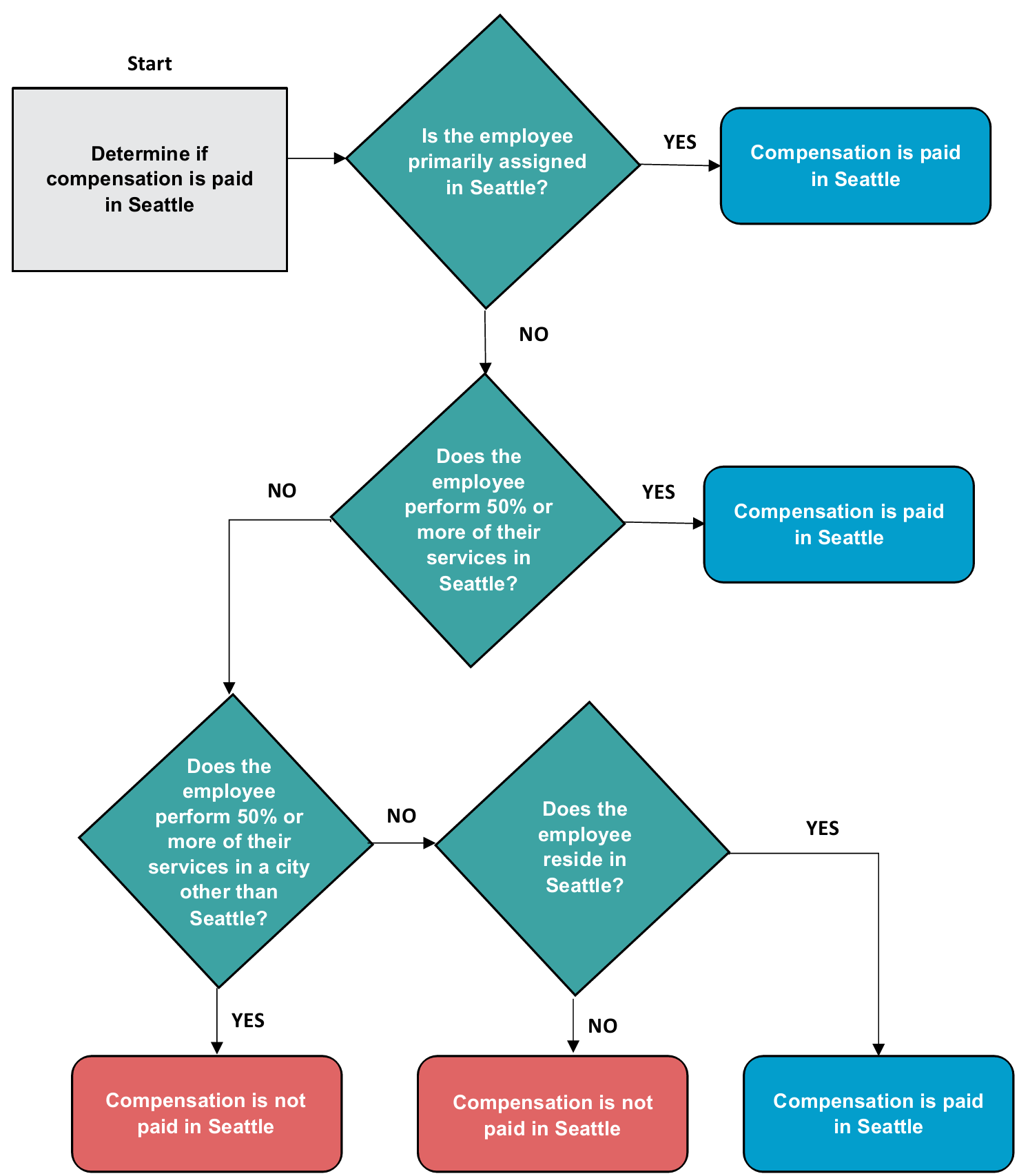

If you contribute more money to accounts. The payroll expense tax also known as JumpStart Seattle City Ordinance 126108. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Ad Intuit QuickBooks Automatically Calculates Federal and State Payroll Taxes. The payroll tax also called JumpStart tax was passed by Seattle City Council in June 2020 and went into effect on January 1 2021. Washington Salary Paycheck Calculator.

Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please. Get Started With ADP.

Salary paycheck calculator guide.

Here S How Much Money You Take Home From A 75 000 Salary

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle Payroll Expense Excise Tax Details

Why The City Of Seattle And Their Police Department Is In Trouble

New Tax Law Take Home Pay Calculator For 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

Gusto Help Center Washington Registration And Tax Info

Income Tax Filing Services Tax Advisors In Kent Wa Seattle Usa

Washington Workers Have A Short Time To Escape A New Payroll Tax The Seattle Times

Washington Paycheck Calculator Smartasset

Business License Tax Seattle Business And Occupation Tax B O Tax Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll

New Seattle Jumpstart Tax Overview Rates More

Seattle S Payroll Expense Tax Upheld By Trial Court Time For Employers To Gear Up For Reporting Insights Davis Wright Tremaine

Seattle Payroll Expense Tax Impacts Businesses With High Income Employees Home Washington Law Firm Stokes Lawrence

What Is The Tax Rate In Seattle Usa Quora

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help