has capital gains tax increase in 2021

New data published today by HMRC has revealed that in the 2020 to 2021 tax year the total amount of Capital Gains Tax CGT liability was 143 billion for 323000 taxpayers. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax Rates 2021 To 2022.

. Get Access to the Largest Online Library of Legal Forms for Any State. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Ad Compare Your 2022 Tax Bracket vs.

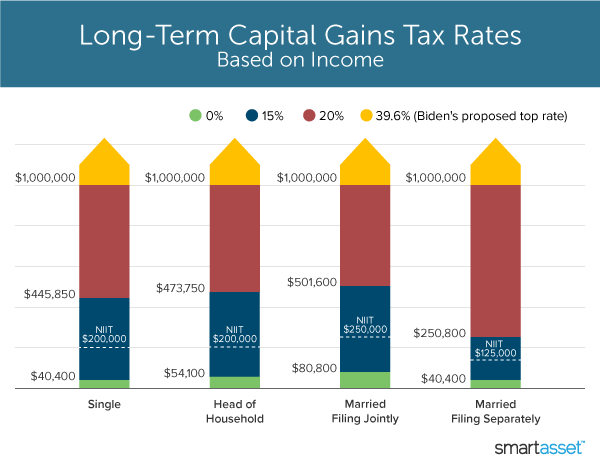

Based on filing status and taxable income long-term capital gains. While it is possible Congress could make any capital gains tax increase retroactive any increase will likely not be effective until 2022. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396.

Assume the Federal capital gains tax rate in 2026 becomes 28. Your 2021 Tax Bracket to See Whats Been Adjusted. You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or 6150 for trusts.

Implications for business owners. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

The current capital gain tax rate for wealthy investors is 20. The new top rate combined with an existing 38 surtax on investment income over. When the NIIT is added in this rate jumps to 434.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. Ad If youre one of the millions of Americans who invested in stocks.

Connect With a Fidelity Advisor Today. Ad Invest in Silicon Valley Real Estate. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell.

Ad Invest in Silicon Valley Real Estate. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. At what income level do you not pay capital gains tax.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. The Chancellor will announce the next Budget on 3 March 2021. Many speculate that he will increase the rates of capital.

Weve got all the 2021 and 2022 capital gains. More broadly because capital gains taxes could jump significantly for those with an income of over 1 million planning now could save a lot of money. See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Discover Helpful Information and Resources on Taxes From AARP. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

What You Need To Know About Capital Gains Tax

Can Capital Gains Push Me Into A Higher Tax Bracket

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What You Need To Know About Capital Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Tax What Is It When Do You Pay It

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

What S In Biden S Capital Gains Tax Plan Smartasset

The Long And Short Of Capitals Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Difference Between Income Tax And Capital Gains Tax Difference Between

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)