inheritance tax rate indiana

Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. Tax rates can change from one year to the next.

Pennsylvania Property Tax H R Block

Indiana Inheritance and Gift Tax.

. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. Indiana taxes capital gains at the same rate as other income 323. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

In Maryland the tax is only levied if the estates total value is more than 30000. State inheritance tax rates range from 1 up to 16. Exemption threshold for class b beneficiaries.

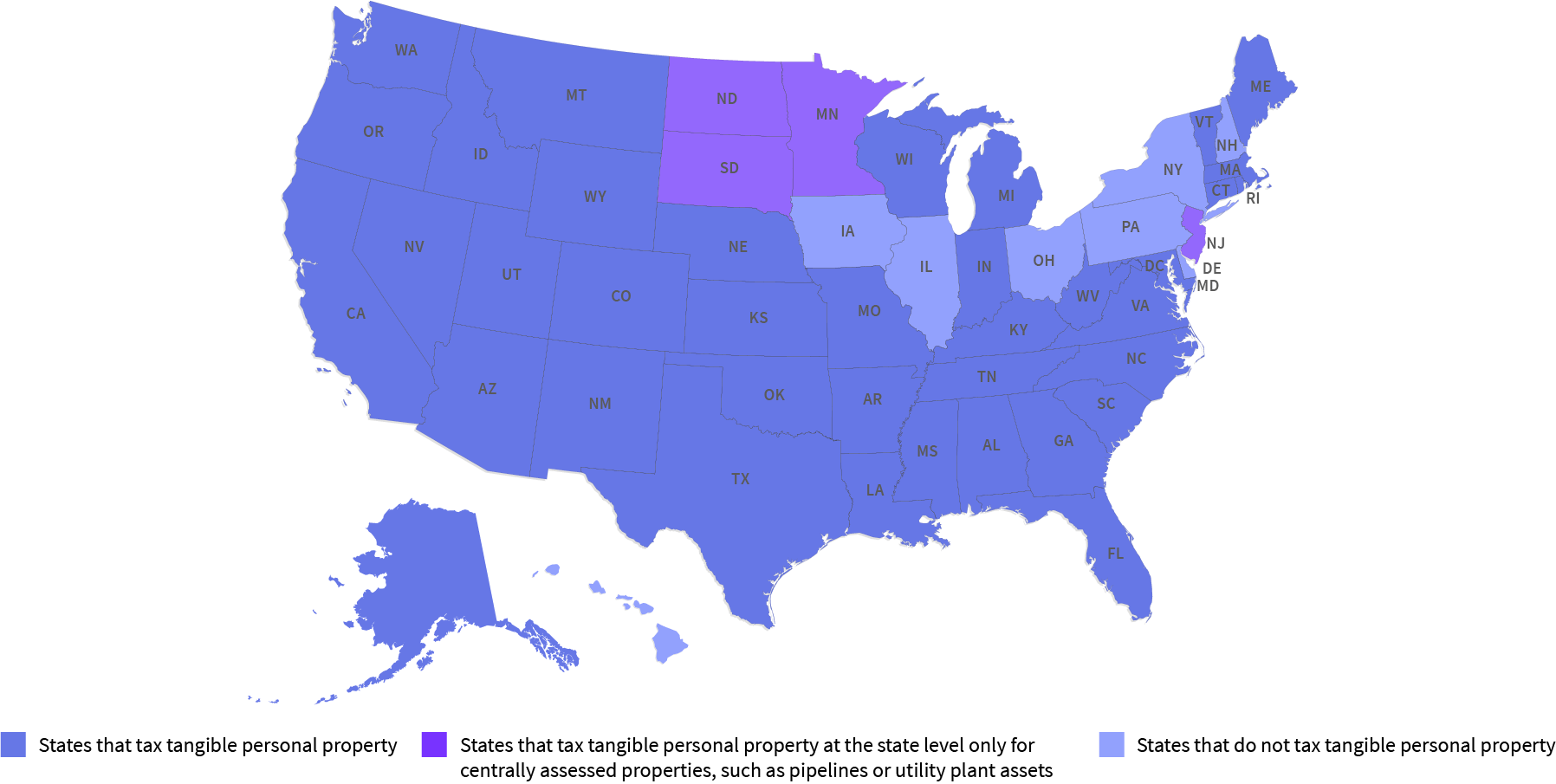

There is no inheritance tax in Indiana either. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

Heres a breakdown of each states inheritance tax rate ranges. The phase out of inheritance tax will commence in 2013 with a 10 credit being applied. A federal estate tax ranging from 18 to 40.

More information can be found in our Inheritance Tax FAQs. Indiana Department of Revenue. Indiana does not have an inheritance tax nor does it have a gift tax.

Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. The current tax rate for class a beneficiaries is from 1 to 10. However other states inheritance laws may apply to you if someone.

The lowest rate is. Tax rates can change from one year to the next. Property owned jointly between spouses is exempt from inheritance tax.

Inheritance and Estate Tax. Keep reading for all the most recent estate and inheritance tax rates by state. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

Therefore without any deductions or planning ahead for the impact of taxes on your. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Inheritance tax rate indiana.

The Iowa tax only applies to inheritances resulting from estates worth more than 25000. Rates and tax laws can change from one year to the next. Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022.

People who receive less than 112 million as part of an estate can exclude all of it from their taxes. Surviving spouses are always exempt. No estate tax or inheritance tax kentucky.

430 pm EST or via our mailing address. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The 1917 amendment provided that gifts made.

Although the tax rates remain unchanged under sea 293 a 10 credit will be subtracted from the amount of the inheritance tax due for decedents who die in 2013. While it typically gets a bad rap probate was added into Indiana inheritance laws to protect the last wishes of a decedent whether he or she had a testate will or not. If you inherited an immovable property youll also need to pay property taxes.

The first inheritance tax law of indiana. However many states realize that citizens can avoid these taxes by simply moving to another state. Your estate would be subject to federal gift and estate taxes for the combined value of 10 million at a tax rate of 40 percent.

Indiana doesnt have an inheritance or estate tax. There is no federal inheritance tax which is defined as a tax levied on the total amount of. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am.

The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred Inheritance Tax 25000 or less. States have typically thought of these taxes as a way to increase their revenues. The top inheritance tax rate is 16 percent exemption threshold for class c beneficiaries.

Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

25000 to 50000 2 over the first 25000 plus 25000. 25000 or less 1. Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going to an heir in Class A is exempt of inheritance tax.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. An Indianapolis estate planning attorney at Frank Kraft discusses whether you need to worry about an Indiana inheritance tax. Inheritance Tax Rate Indiana.

There is also a tax called the inheritance tax. For example Indiana once had an inheritance tax but it was removed from state law in 2013. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Trusts and Estate Tax Rates of 2022. For example a lucky grandchild who inherits 150000 would owe tax on 50000 because for Class A beneficiaries no tax is due on the first 100000 inherited. Estate tax rates vary from state to state.

45 percent on transfers to direct descendants and lineal heirs. INDIANA INHERITANCE TAX GENERAL INSTRUCTIONS IH-6 Instructions Indiana Department Of Revenue Rev. Estates over the first 10000000 the tax is as follows.

This number doubles to 224 million for married couples. Capital Gains Taxes. The act was amended in 1915 1917and 1919.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. In maryland the tax is only levied if the estates total value is more than 30000. The District of Columbia moved in the.

The Probate Process In Indiana Inheritance Law. Inheritance tax applies to assets after they are passed on to a persons heirs.

Indiana Estate Tax Everything You Need To Know Smartasset

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Housing Tax Estate Tax Tax Rate Tax

2021 Estate Income Tax Calculator Rates

States With Highest And Lowest Sales Tax Rates

How High Are Capital Gains Taxes In Your State Tax Foundation

Property Tax Rates Across The State

Property Tax Rates Across The State

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Pin By The Kandi Lowe Team Remax On Everything Remax Indiana Real Estate Remax Real Estate Real Estate Marketing

Comparing The Cost Of Owning And Operating Commercial Real Estate Across The United States Corelogic

How Is Tax Liability Calculated Common Tax Questions Answered

Indiana Estate Tax Everything You Need To Know Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington